Introduction

Crypto markets are volatile by their nature and traders witness large swings in crypto asset prices during the day.

A strategy that can buy when the prices drop and sell when the prices are rising can harvest massive profits from the crypto market.

How can you profit from Crypto volatility?

Buying at the lows and selling at the highs and repeating the process 24/7 on autopilot can return up to 10-15% profits within a month with the correct type of automating trading system.

Cryptocurrencies such as Bitcoin, Ethereum, Ripple or Cardano are volatile assets, which presents a great opportunity if you have the necessary tools to take advantage of their volatility.

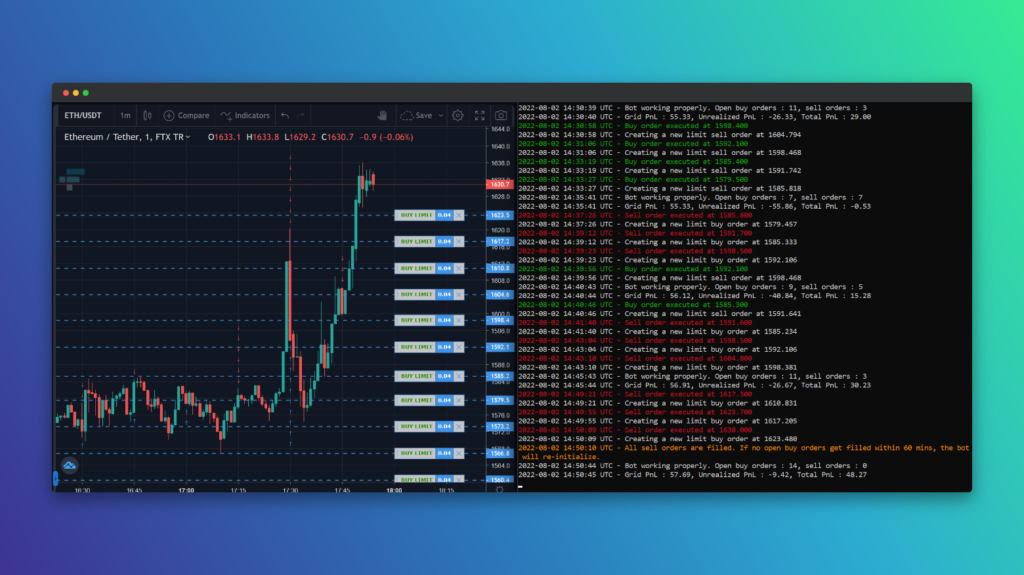

Submitting multiple levels of buy and sell orders like a ladder can make it possible to buy more when the prices keep falling and sell high when the prices are rising.

As the limit buy and sell orders get filled over and over again, the users of the algorithmic trading bot can harvest consistent profits thanks to the volatility in the crypto markets.

Taking advantage of the crypto price volatility becomes much easier with an automated grid trading strategy.

Market Making using a Grid Strategy in Cryptocurrency markets

You’re basically acting as a market maker in the crypto markets by submitting orders to the crypto exchanges in a similar way to a hedge fund placing orders to the order book in stock markets.

You’re now market making in crypto by adding orders to the order book and profiting from the spread between the buy and sell orders.

An algorithmic crypto trading system submits a grid of buy and sell orders depending on the predetermined settings by the user, and submits an opposite order once a buy or sell order gets filled.

Once the price falls below a limit buy order, an opposite limit sell order gets submitted by the crypto trading bot immediately. Also, once the price raises above a limit sell order, an opposite buy order will be placed below the filled price immediately.

Trading Cryptocurrencies algorithmically is the way to go

FinBrain Algorithmic Trading Bot makes it possible for the individual crypto traders to connect and trade algorithmically on Binance, Binance US, FTX and FTX US exchanges.

Day trading Bitcoin or Ethereum becomes much easier with our automated crypto trading systems and you can generate profits even while you’re sleeping.

Another advantage of trading the cryptocurrencies over trading the stocks is that, you don’t need a brokerage account to connect to an exchange. You can directly trade on an exchange and you can even automate the process of buying and selling crypto assets like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Cardano (ADA) and Solana (SOL).

You can trade any available crypto pair on Binance and FTX using FinBrain’s Algorithmic Trading Bot. You can trade Ethereum for USDT, BNB, USDC as well other cryptocurrencies.

Volatility in Ethereum has increased after the merge and it was such a great time to trade ETH using an automated trading bot.

At the times when an increase in volatility is expected, you can set the bot parameters to increase the grid order numbers and the distance between the grid orders to take advantage of the larger price swings.

When the volatility starts to drop, you can narrow the separation between the grid orders down and take profits more frequently as the orders get filled more often with smaller grid size.

The bot parameters are totally adjustable, which gives the user the freedom to adjust how many levels of buy and sell orders the bot should place, also determine the separation between the grid orders and set the order size of each limit buy or sell order.

A smooth algorithmic trading experience for the individual crypto traders

FinBrain Team always makes sure the bots keep running smoothly for all users, keeps the code base updated and helps the traders from all over the world to setup and run their algorithmic trading system easily.

Our customer service representatives are always happy to assist crypto traders on determining the bot settings, deploying the bot on a cloud server and keeping the bot running smoothly without any outside intervention.

Once you set the bot, you can just forget about it and it’ll handle all actions like initializing, connecting to the exchange, submitting orders, canceling orders, placing the opposite grid orders and so on.

Our team works hard to make sure that you have a smooth crypto trading experience without any issues and interruptions. You can trade Bitcoin, Ethereum, Ethereum Classic or any other crypto asset without staying in front of the computer all day.

It’s so much easier to automate the process of day trading cryptocurrencies using a rule based trading system that removes emotions from trading.

Trading Ethereum or any other crypto asset is emotionally challenging and it’s definitely a wise move to follow the plan once the volatility increases and initiates panic in the crypto markets.

That’s exactly the best time to trade cryptocurrencies using an automated trading system that follows a grid trading strategy and takes advantage of the volatility increase in the markets.

You basically don’t need to know how to trade Ethereum or any other cryptocurrency using technical indicators or charts. You only need to employ the strategy and system that works the best for a market that tends to be volatile almost all the time.

AI and Data Driven investing in Cryptocurrencies

If you’re not so much into day trading Ethereum, you can also choose to swing trade ETH or other crypto assets. However, that’s where the informational edge comes becomes more important in terms of generating decent profits in the cryptocurrency market.

You might want to analyze the AI generated predictions and news sentiment data for Ethereum before taking any trades.

FinBrain encourages people to invest with a data driven approach in stock, forex, futures and cryptocurrency markets and democratizes the AI forecast algorithms and alternative datasets for the individual investors from all over the world.

The AI algorithms analyze the crypto asset price formations over time and extract the dynamics of the price movements. The machine learning models trained over the years of crypto data are used to forecast the future price movements of the cryptocurrencies like Bitcoin, Ethereum and Solana.

Start your algorithmic trading and data driven investing journey with FinBrain Technologies today.

FinBrain Technologies

99 Wall St. #2023 NY10005 New York