Introduction to Crypto Bot Trading

Crypto bot trading is an automated trading system that uses advanced algorithms to execute trades on cryptocurrency markets. These bots monitor market data and make decisions based on predefined strategies, aiming to generate profits for the user. With automated crypto trading, traders can take advantage of market fluctuations without having to monitor their investments constantly.

Some of the most common types of crypto trading bots include Bitcoin trading bots, altcoin trading bots, and customizable bots that support multiple cryptocurrencies.

How Do Crypto Trading Bots Work?

Crypto trading bots work by leveraging algorithmic trading techniques to analyze market data and make informed decisions. The algorithms take into account factors such as price trends, trading volume, and historical data to identify profitable opportunities. Once a suitable trade is identified, the bot will execute the order on behalf of the user.

FinBrain Technologies, for example, provides AI stock forecasts for cryptocurrencies and uses their algorithmic trading bot to continuously buy low and sell high using a grid strategy. This approach allows traders to profit from market volatility.

Are Crypto Trading Bots Profitable?

Crypto trading bots can be profitable if used correctly and with a well-defined strategy. However, they are not a guaranteed path to success, and individual results may vary. Traders should carefully consider their risk tolerance and investment goals before using a crypto trading bot.

Crypto bot trading strategies vary widely, and some bots may perform better than others depending on market conditions and the specific strategy being used. It’s essential to research and select a bot that aligns with your trading objectives and risk appetite.

Best Crypto Trading Bots

There are numerous crypto trading bots available on the market, each with its own set of features and strategies. Some of the best crypto trading bots include:

- Free crypto trading bots: These bots provide basic functionalities and can be a good starting point for beginners.

- Crypto trading bots for beginners: These bots are designed with user-friendly interfaces and simplified strategies to help new traders navigate the crypto market.

- Open-source crypto trading bots: These bots allow users to access and modify the underlying code, providing maximum customization and transparency.

- Customizable crypto trading bots: These bots offer advanced features and tools for experienced traders who wish to fine-tune their trading strategies.

When selecting a crypto trading bot, it’s important to consider factors such as ease of use, available features, support for your preferred cryptocurrencies, and the bot’s overall reputation in the trading community.

Creating a Crypto Trading Bot

If you have programming skills and a good understanding of trading strategies, you can create your own crypto trading bot. Here are the basic steps to follow:

- Choose a programming language: Select a language that you are comfortable with and that is compatible with the APIs of your chosen cryptocurrency exchanges.

- Select an API: Choose a cryptocurrency exchange API that allows you to access market data, manage your account, and execute trades programmatically.

- Develop your strategy: Create an algorithm based on your preferred trading strategy, incorporating factors such as technical indicators, risk management, and position sizing.

- Implement your bot: Write the code for your bot, integrating the chosen API and your trading algorithm.

- Test your bot: Backtest your bot using historical data to evaluate its performance and fine-tune the strategy as needed.

- Deploy your bot: Once satisfied with your bot’s performance, deploy it on a live account and monitor its performance regularly.

Choosing the Right Crypto Trading Bot

To choose the right crypto trading bot, consider the following factors:

- Features: Evaluate the features and tools offered by each bot, ensuring they align with your trading needs and goals.

- Ease of use: Look for a bot with a user-friendly interface, especially if you are a beginner.

- Compatibility: Ensure the bot supports your preferred cryptocurrencies and exchanges.

- Reputation: Research the bot’s reputation within the trading community and read user reviews to gauge its effectiveness and reliability.

- Cost: Consider the bot’s pricing structure and any additional fees, such as subscription costs or commissions.

- Customer support: Select a bot with responsive and knowledgeable customer support to assist you with any issues or questions that may arise.

Grid Trading Strategy and Grid Trading Bots

Grid trading is a popular strategy among crypto traders, as it takes advantage of the inherent volatility in the cryptocurrency markets. In this section, we will explore grid trading strategies, grid trading bots, and how users can benefit from this approach.

What is Grid Trading?

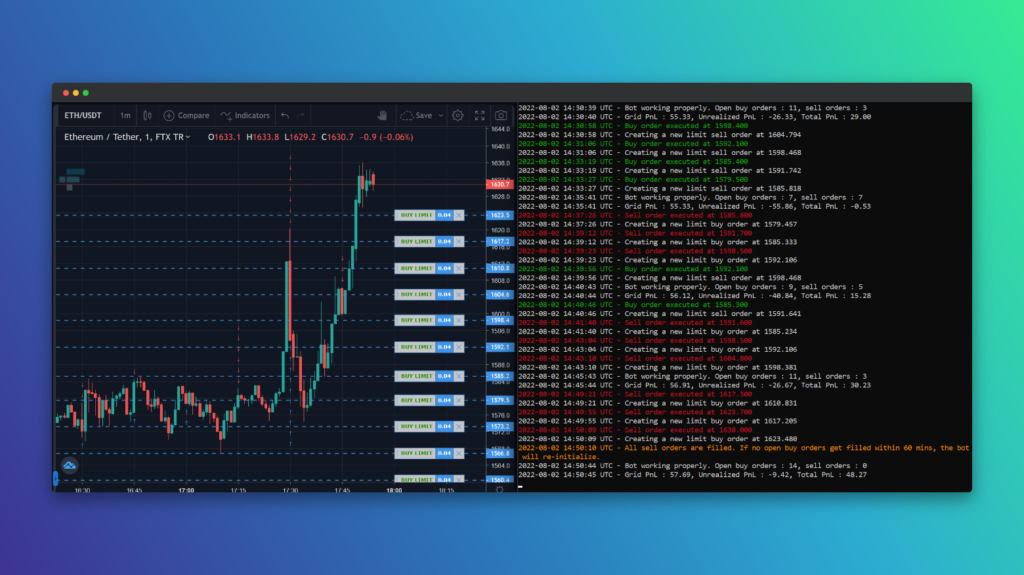

Grid trading is a technique that involves placing multiple buy and sell orders at predetermined price intervals (or “grid levels”) within a specific trading range. The primary goal of this strategy is to capitalize on price fluctuations by profiting from both rising and falling markets. As prices move up and down within the grid, the bot executes buy orders at lower levels and sell orders at higher levels, capturing profits along the way.

Grid Trading Bots

A grid trading bot is an automated trading system that executes the grid trading strategy on the user’s behalf. These bots monitor market data, identify suitable trading ranges, and place buy and sell orders at the predefined grid levels. Grid trading bots can be customized to work with any cryptocurrency pair and are typically compatible with popular exchanges such as Binance, Binance US, and FTX.

FinBrain Algorithmic Trading Bot is an example of a grid trading bot that operates on this strategy. The bot leverages the power of AI-assisted and data-driven investing to harvest profits 24/7 on autopilot. It can be used for any cryptocurrency pair by connecting to supported exchanges, allowing traders to take full advantage of the crypto market’s volatility.

Customizing Grid Trading Bots

One of the key benefits of using a grid trading bot like FinBrain’s is the ability to customize the bot parameters to suit your trading preferences and risk appetite. Users can adjust settings such as grid sizes, the number of grid levels, and the trading range to align with their specific investment goals. This level of customization enables traders to optimize their grid trading strategy, maximizing potential returns while minimizing risk.

Legal Aspects of Crypto Trading Bots

While crypto trading bots are generally legal, the legal status may vary depending on your jurisdiction and the specific activities performed by the bot. It’s essential to familiarize yourself with the regulations in your country to ensure compliance.

Some countries may require traders using bots to register as financial service providers, while others may have specific rules governing the use of automated trading systems. Always consult with a legal professional if you have concerns about the legality of using a crypto trading bot in your jurisdiction.

Conclusion

Crypto bot trading offers a convenient and efficient way to navigate the complex world of cryptocurrency markets. By automating the trading process, traders can take advantage of market opportunities without constant monitoring. However, it’s crucial to select a reputable and reliable bot that aligns with your trading objectives and risk tolerance.

FinBrain Technologies is an excellent resource for AI crypto price forecasts and alternative financial data, providing traders with valuable insights to help maximize their returns. With the right tools and strategies in place, crypto bot trading can be a powerful asset in your trading arsenal.

FinBrain Technologies

Twitter • LinkedIn • Instagram • Facebook

99 Wall St. Suite #2023, New York, NY 10005