Introduction to Automated Crypto Trading

The world of cryptocurrency trading is complex, volatile, and often difficult to navigate. Many traders are looking for new ways to optimize their strategies and increase their returns. One such method is automated crypto trading. As the name suggests, this approach leverages technology to execute trades automatically, based on predetermined parameters set by the trader.

Understanding Automated Crypto Trading

Automated crypto trading is a strategy that employs software or trading bots to execute cryptocurrency trades on behalf of the trader. This method is gaining popularity due to its ability to operate 24/7, execute trades faster than a human, and minimize emotional trading decisions. There are different types of automated crypto trading software available in the market, each offering various features and functionality to cater to diverse trading needs.

Getting Started with Automated Crypto Trading

Starting with automated crypto trading may seem daunting, but the process is fairly straightforward. First, you need to choose a trading bot or platform that aligns with your trading goals and risk tolerance. Next, you will need to set up your trading bot, a process that involves configuring your preferred trading parameters such as the cryptocurrency pair, trading volume, and the conditions under which the bot should execute trades. Finally, you can deploy your bot to start trading on your behalf.

Automated Crypto Trading Platforms

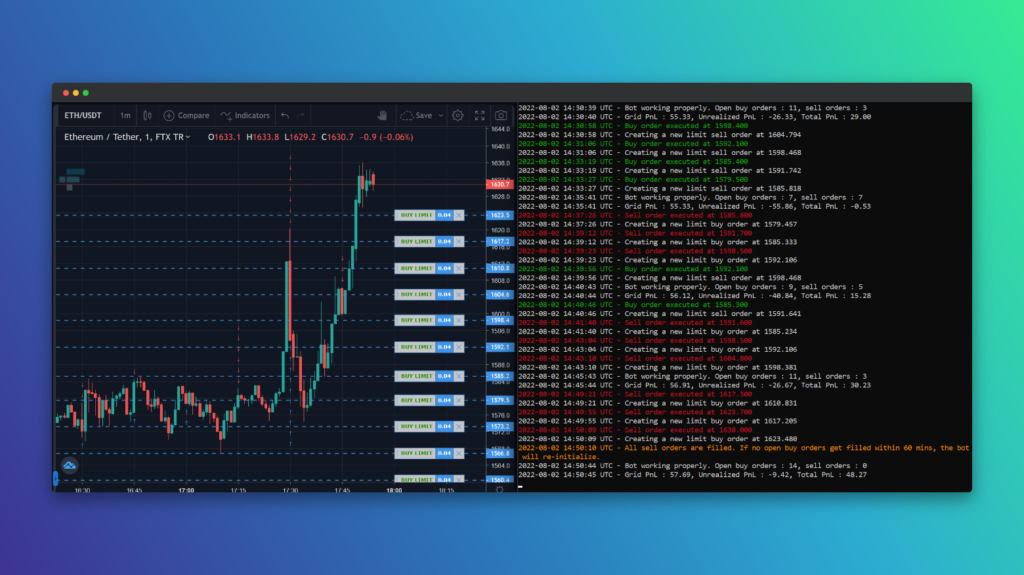

There are several platforms available that offer automated crypto trading. Some of the most popular ones include Binance, Binance US, and FTX. These platforms not only offer their proprietary trading bots but also allow users to connect third-party bots. One such bot is the FinBrain Algorithmic Trading Bot, which operates using a grid strategy, continuously buying low and selling high.

Risks and Benefits of Automated Crypto Trading

Automated crypto trading, like any trading strategy, comes with its share of risks and benefits. On the plus side, it allows for round-the-clock trading, eliminates

Automated crypto trading, while offering a range of benefits, also comes with its set of risks. Understanding these can help traders make informed decisions and optimize their trading strategies.

Benefits of Automated Crypto Trading

- Round-the-Clock Trading: Crypto markets operate 24/7, which can make it difficult for individual traders to keep up. Automated trading bots can monitor and trade in these markets continuously, ensuring no opportunities are missed.

- Speed and Efficiency: Automated trading bots can process information and execute trades far quicker than humans, making the most of short-lived trading opportunities.

- Emotionless Trading: Automated trading eliminates emotional decision-making, which can often lead to impulsive trading decisions. Bots stick to the set strategy and make decisions based purely on data.

- Backtesting Capability: Many trading bots allow for backtesting – testing trading strategies against historical market data. This can help traders fine-tune their strategies before implementing them in real market conditions.

- Diversification: Bots can monitor and trade many cryptocurrencies simultaneously, allowing for portfolio diversification and risk management.

Risks of Automated Crypto Trading

- Market Volatility: The volatile nature of cryptocurrency markets can lead to rapid, unexpected price movements. While this volatility can present trading opportunities, it also increases risk.

- Bot Reliability: Not all bots are created equal, and the effectiveness of a bot is directly tied to its programming and strategy. Poorly designed bots or those that use ineffective strategies can lead to losses.

- Cybersecurity Threats: Automated trading relies on technology, which can be susceptible to hacking and other cybersecurity threats. Secure API keys and regularly updated security measures are critical.

- Over-Reliance on Automation: While automation can streamline the trading process, it’s not a substitute for human judgment. Over-reliance on automation can lead to complacency and missed warning signs.

- Regulatory Risks: The regulatory environment for cryptocurrencies is still developing and can vary significantly by region. Changes in regulations can impact crypto markets and automated trading activities.

Automated Crypto Trading Bots and Their Functionality

Trading bots are central to automated crypto trading. These software programs use algorithms and trading strategies to execute trades on behalf of their users. They analyze market actions, such as time, price, orders, and volume, to make decisions based on the parameters set by the trader.

How Do They Work?

Automated crypto trading bots work by monitoring the market’s price movement and reacting according to a set of predefined and pre-programmed rules. Depending on the specific bot and strategy, this could include tracking market trends, managing risk, determining when to enter or exit trades, and even rebalancing portfolios.

Bots execute trades through API keys that are connected to crypto exchanges. These keys allow the bot to send and receive trading orders while maintaining the security of the trader’s funds.

Types of Trading Bots

There are several types of trading bots available in the market, each with their unique features and strategies. Here are a few common ones:

- Trend-Trading Bots: These bots analyze trends in the market and execute trades based on these trends. They are suitable for markets with a clear upward or downward direction.

- Arbitrage Bots: These bots take advantage of the price differences for the same asset on different exchanges. They buy at a lower price from one exchange and sell at a higher price on another.

- Market Making Bots: These bots create buy and sell limit orders near the market price on both sides of the order book. The aim is to earn the bid-ask spread.

- Grid Trading Bots: Grid bots place several buy and sell limit orders at different price levels around the current market price, creating a grid-like formation. The bot will buy when the price falls and sell when the price rises, capturing profit within the grid.

Key Features and Functions of Trading Bots

- 24/7 Trading: One of the primary features of trading bots is their ability to operate 24/7. Unlike human traders, bots don’t need to sleep or take breaks. This allows them to take advantage of any market movement, regardless of the time of day.

- Speed and Efficiency: Trading bots can process information and execute trades much faster than a human can. This means they can capitalize on short-term market fluctuations more efficiently.

- Emotionless Trading: Emotional trading can often lead to poor decisions, such as panic selling or greed-fueled buying. Bots, being emotionless, make decisions purely based on data, eliminating the risk of emotional trading.

- Multiple Exchange Compatibility: Most trading bots are compatible with multiple exchanges, giving traders the flexibility to operate on their preferred platforms.

- Customizable Parameters: Trading bots often allow users to customize various parameters such as trading pairs, amounts to invest, risk levels, and more, tailoring the trading process to each individual’s strategy and goals.

Grid Trading Bots

A specific type of trading bot worth highlighting is the grid trading bot. These bots operate on a grid trading strategy, which involves placing buy and sell orders at regular intervals around a set price point. The main objective of this strategy is to capitalize on market volatility by buying low and selling high.

The FinBrain Algorithmic Trading Bot is an example of a grid trading bot. It continuously buys lows and sells highs, profiting from market volatility. The bot is compatible with Binance, Binance US, and FTX, and its parameters, including grid sizes, can be customized by the user.

The FinBrain bot can be used for any cryptocurrency pair, making it a flexible tool for diverse trading strategies. Through its 24/7 operation and automated execution, it allows traders to potentially reap profits even when they’re not actively monitoring the markets.

Profitability of Automated Crypto Trading

Automated crypto trading can be profitable, but it’s not a guaranteed pathway to wealth. Its success heavily depends on various factors, such as the initial investment, the effectiveness of the trading bot, the accuracy of the trading strategy, and the volatility of the cryptocurrency market.

- Initial Investment: The amount of capital you’re willing to invest plays a significant role in determining potential returns. A larger investment can result in more substantial profits, but it also exposes you to higher risks. It’s essential to start with an amount you’re comfortable losing, given the volatile nature of cryptocurrency markets.

- Trading Bot Effectiveness: The performance of your trading bot is another critical factor. Not all bots are created equal, and their effectiveness can vary significantly. An efficient bot should be able to execute trades swiftly and accurately, make data-driven decisions, and adapt to changing market conditions.

- Trading Strategy Accuracy: The accuracy of the trading strategy employed by the bot is vital for profitability. A well-designed strategy should account for various market scenarios and include risk management measures. Strategies can range from simple ones like following market trends to more complex ones like arbitrage and market making.

- Market Volatility: Cryptocurrency markets are known for their high volatility. While this can present significant opportunities for profit, it also comes with increased risk. A successful automated trading strategy should be able to effectively navigate market volatility and capitalize on price fluctuations.

- The Role of Grid Trading Bots: Grid trading bots, like the FinBrain Algorithmic Trading Bot, can be particularly effective in volatile markets. These bots place multiple buy and sell orders at different price levels, allowing them to buy low and sell high repeatedly.

- Importance of Continuous Monitoring: While automated crypto trading can potentially yield substantial profits, it’s not a set-and-forget solution. Continuous monitoring and adjustments are necessary to ensure the trading bot remains effective in changing market conditions. Regularly reviewing performance, adjusting strategies, and staying informed about market trends are all part of a successful automated trading journey.

Choosing the Best Automated Crypto Trading Platform

To get the most out of automated crypto trading, it’s crucial to select the right platform and bot. Here are some tips on how to choose the best automated crypto trading platform:

- Research and compare platforms: Evaluate different platforms based on their features, fees, user reviews, and the range of cryptocurrencies supported.

- Consider your trading goals and risk tolerance: Choose a platform and bot that align with your trading objectives and risk appetite.

- Look for customization options: Opt for platforms and bots that offer customizable trading parameters to suit your unique trading style.

- Evaluate the trading bot’s performance: Analyze the historical performance of the trading bot and consider its success rate, accuracy, and consistency.

- Verify security measures: Ensure that the platform has robust security measures in place to protect your funds and personal information.

Conclusion

Automated crypto trading is an innovative approach to cryptocurrency trading that can help traders optimize their strategies and potentially increase their returns. By using advanced trading bots, such as the FinBrain Algorithmic Trading Bot, traders can take advantage of AI-powered insights, customizable trading parameters, and 24/7 trading capabilities. While automated trading has its risks, with the right platform and bot, it can be an effective tool for navigating the volatile world of cryptocurrencies.

FinBrain Technologies

Twitter • LinkedIn • Instagram • Facebook

99 Wall St. Suite #2023, New York, NY 10005