Introduction

Understanding Cryptocurrencies

Cryptocurrencies represent a form of digital or virtual currency that relies on cryptographic technologies for secure, decentralized transactions. The most prominent example of this is Bitcoin, which was introduced in 2009 as a peer-to-peer electronic cash system free from central authorities like banks or governments. Since then, the cryptocurrency market has expanded dramatically, now including thousands of unique cryptocurrencies, with Ethereum being another significant player.

Cryptocurrencies operate on a technology called blockchain, a decentralized technology spread across many computers that manages and records transactions. Part of the appeal of this technology is its security. Each “coin” or “token” is an individual entry in a blockchain ledger, with transactions confirmed by a network of computers, or “nodes,” in a process called mining.

The Role of Algorithms in Crypto Trading

Crypto trading algorithms play a pivotal role in the modern cryptocurrency market. These automated software solutions are designed to make trading decisions on behalf of the trader, based on predefined parameters or strategies. The algorithms can analyze a wide range of data, from price and volume to news sentiment and historical trends, allowing them to make highly informed trading decisions in real time.

Crypto trading algorithms have become popular due to their ability to process vast amounts of information quickly, make decisions based on this data, and execute trades faster than any human could. They help in eliminating emotional and psychological biases that often affect human traders, thereby enabling a more disciplined and efficient approach to trading.

There are various types of crypto trading algorithms, including those designed for high-frequency trading, arbitrage, and automated crypto trading, among others. Each has its unique features and benefits, and understanding their functionalities can significantly enhance a trader’s profitability and efficiency in the volatile crypto market.

What is a Crypto Trading Algorithm?

Definition and Purpose

A crypto trading algorithm, also known as a crypto trading bot, is an automated software program that conducts trades on cryptocurrency exchanges based on predefined rules and strategies. These algorithms use a combination of factors such as price, timing, and volume data, along with complex mathematical and statistical models, to make informed trading decisions.

The primary purpose of a crypto trading algorithm is to identify profitable trading opportunities and execute trades more efficiently and quickly than a human trader could. It removes emotional and psychological biases from the trading process, thus enabling a more disciplined and objective approach to trading.

Crypto trading algorithms are a part of algorithmic trading, which has been prevalent in traditional stock and forex markets for some time. However, given the 24/7 nature of the cryptocurrency market and its inherent volatility, these algorithms have gained significant traction in crypto trading.

The Key Types of Crypto Trading Algorithms

There are several key types of crypto trading algorithms, each designed with a specific strategy in mind. Some of the most common types include:

- High-frequency Trading Algorithms: These algorithms capitalize on small price discrepancies that occur in fractions of a second. They can make a large number of trades in a very short time, taking advantage of even the smallest market movements.

- Arbitrage Trading Algorithms: These algorithms identify and exploit price differences of the same cryptocurrency on different exchanges. They buy at a lower price on one exchange and sell at a higher price on another, thereby earning a profit from the price discrepancy.

- Market Making Algorithms: Also known as a grid trading bot, these algorithms aim to profit from the bid-ask spread by placing orders on both sides of the order book and profiting from each transaction.

- Trend Following Algorithms: These algorithms analyze historical price data to identify trends and make trades based on these trends. They can use various indicators like moving averages, price level movements, and other technical analysis tools.

- Machine Learning Algorithms: These are advanced algorithms that use artificial intelligence to learn from historical data and make informed predictions about future market movements. They can adapt their strategies based on new data and improve their performance over time.

- Predictive Algorithms: These algorithms use a variety of factors, such as historical price data and market indicators, to predict future price movements of cryptocurrencies.

It’s important to note that the efficiency and success of a crypto trading algorithm depend significantly on the chosen strategy, market conditions, and the algorithm’s ability to adapt to changing market dynamics.

How Does a Crypto Trading Algorithm Work?

The Trading Process

At its core, a crypto trading algorithm is a predefined set of rules for executing trading actions on a cryptocurrency exchange. The algorithm operates by scanning and analyzing the market continuously, identifying potential trading opportunities based on these predefined rules, and then executing trades when these conditions are met.

The rules can be as simple or as complex as needed, based on factors such as price, volume, time, and even complex mathematical models. Here’s a basic overview of the trading process:

- Data Collection: The algorithm starts by collecting market data from the cryptocurrency exchange. This includes real-time price data, trading volume, order book depth, and more.

- Data Analysis: After collecting the data, the algorithm analyses it based on the pre-set rules. This analysis may involve identifying trends, calculating indicators, or applying mathematical models to predict future price movements.

- Signal Generation: Once the analysis is complete, the algorithm generates a trading signal if the conditions match the pre-set rules. This signal indicates whether to buy, sell, or hold the cryptocurrency.

- Order Execution: If a trading signal is generated, the algorithm proceeds to execute the trade on the cryptocurrency exchange. The order execution process can involve additional rules for risk management, such as setting stop-loss and take-profit levels.

- Performance Tracking: After executing the trade, the algorithm tracks its performance to assess its effectiveness. This information is used for backtesting and improving the algorithm’s rules and parameters.

High-frequency Crypto Trading

High-frequency crypto trading is a specific type of algorithmic trading that aims to capitalize on minute price changes in the cryptocurrency market. High-frequency trading algorithms operate on a similar process as described above, but with a few notable differences:

- Speed: High-frequency trading algorithms are designed for speed. They use advanced technology to execute trades in fractions of a second, faster than any human trader could.

- Number of Trades: High-frequency trading algorithms make a high number of trades, often in the thousands or even millions per day. They take advantage of tiny price discrepancies that might only exist for a fraction of a second.

- Strategy: High-frequency trading algorithms typically use strategies such as market making or arbitrage, where profits are made off small price differences rather than large market movements.

High-frequency crypto trading can be extremely profitable due to the volatile nature of the cryptocurrency market. However, it also requires sophisticated technology and a deep understanding of the market to execute effectively.

Creating Your Own Crypto Trading Algorithm

Guide to Developing a Crypto Trading Algorithm

Creating your own crypto trading algorithm can be a rewarding endeavor, allowing you to customize your trading strategies according to your personal risk tolerance and investment goals. Here is a step-by-step guide to help you develop your own crypto trading algorithm:

- Identify Your Trading Strategy: The first step in creating a crypto trading algorithm is to identify the trading strategy you want the algorithm to follow. This could be anything from high-frequency trading, arbitrage, trend following, or any other strategy you think would be profitable in the crypto market.

- Data Collection and Analysis: Next, you’ll need to gather historical crypto price data for backtesting your algorithm. This data is used to simulate how your algorithm would have performed in the past. You’ll also need to develop an understanding of how to analyze this data according to your chosen strategy.

- Coding the Algorithm: Once you have your strategy and data, you’ll need to code your algorithm. This typically requires proficiency in a programming language such as Python or JavaScript. You’ll need to code the rules for when to buy and sell, as well as any other conditions you want your algorithm to follow.

- Backtesting: Before deploying your algorithm, you’ll need to backtest it using your historical price data. Backtesting allows you to see how your algorithm would have performed in the past and make any necessary adjustments before putting it to work in live trading.

- Implementing and Monitoring: After backtesting and fine-tuning your algorithm, it’s time to put it into action. However, your job doesn’t stop there. It’s crucial to monitor your algorithm’s performance regularly, making adjustments as necessary to respond to changing market conditions.

Remember that developing a crypto trading algorithm requires a certain level of technical proficiency and a good understanding of both the crypto market and algorithmic trading. It may take some time to create a successful algorithm, and there’s always risk involved, so it’s important to never invest more than you can afford to lose.

Understanding the Technology Behind Crypto Trading Algorithms

Understanding the technology behind crypto trading algorithms is crucial for developing and refining your own algorithm. Here are some key technologies and concepts to familiarize yourself with:

- Programming Languages: Crypto trading algorithms are typically written in programming languages such as Python, JavaScript, or C++. Python is particularly popular due to its simplicity and the wide range of financial and data analysis libraries available.

- APIs: Application Programming Interfaces (APIs) are used to connect your algorithm to the cryptocurrency exchange. The API allows your algorithm to retrieve real-time price data, place trades, and more.

- Machine Learning: Machine learning, a subset of artificial intelligence (AI), can be used to enhance your crypto trading algorithm. Machine learning algorithms learn from historical data to make predictions about future price movements.

- Blockchain Technology: As the underlying technology of cryptocurrencies, understanding blockchain technology can help you better understand the crypto market’s dynamics. This includes concepts such as mining, proof-of-work, and smart contracts.

- Technical Analysis: Many crypto trading algorithms use technical analysis, a method of predicting future price movements based on historical price data and statistical measures.

By understanding these technologies and concepts, you can create a more effective and profitable crypto trading algorithm.

Benefits of Using a Crypto Trading Algorithm

Efficiency and Profitability

One of the main benefits of using a crypto trading algorithm is the increased efficiency it offers. Algorithms are capable of processing vast amounts of data and executing trades at a speed that no human trader can match. This rapid data analysis and order execution can lead to more profitable trading opportunities, as the algorithm can capitalize on price movements that might be missed by a human trader.

Moreover, crypto trading algorithms can operate around the clock, taking advantage of the 24/7 nature of the cryptocurrency market. Unlike human traders, algorithms don’t need to sleep, eat, or take breaks, meaning they can continue trading and potentially making profits at all times.

Crypto trading algorithms also remove emotional and psychological biases from the trading process. Human traders can often make poor trading decisions due to fear, greed, or other emotions, leading to sub-optimal outcomes. Algorithms, on the other hand, strictly follow the rules and strategies they’ve been programmed with, leading to more disciplined and potentially more profitable trading.

Trading in Volatile Markets

Cryptocurrency markets are known for their high volatility, with prices often experiencing significant fluctuations in short periods. This volatility can present both risks and opportunities for traders.

Crypto trading algorithms can be particularly beneficial in such volatile markets. They can rapidly respond to price changes, executing trades to capitalize on these fluctuations. This can be especially useful in high-frequency trading strategies, where the algorithm aims to make profits from small price movements that occur in fractions of a second.

Furthermore, crypto trading algorithms can be programmed with risk management rules to help protect against the downside of volatility. For example, the algorithm can be set to automatically sell a cryptocurrency if its price drops below a certain level, helping to limit potential losses.

In conclusion, crypto trading algorithms offer several benefits, including increased efficiency, the potential for higher profitability, and the ability to effectively trade in volatile markets. However, like all trading strategies, they also involve risk, and it’s important to thoroughly understand how they work before using them.

Is Crypto Trading Algorithm Safe and Legal?

Safety Concerns and Measures

The safety of using a crypto trading algorithm largely depends on the precautions taken by the user and the platform or service that provides the algorithm. Here are some safety concerns and measures to keep in mind:

- Platform Security: It’s crucial to choose a platform or service with robust security measures in place. This includes encryption of sensitive data, two-factor authentication, and regular security audits.

- API Key Security: When connecting your trading algorithm to a cryptocurrency exchange via API, ensure that the API keys are stored securely. Never grant withdrawal permissions to your API keys to prevent unauthorized withdrawals from your account.

- Algorithmic Risk: Algorithms, like any trading strategy, carry inherent risk. Ensure that your algorithm includes risk management strategies, such as stop-loss orders, to limit potential losses.

- Software Bugs: Errors in the algorithm’s code can lead to unexpected behavior or losses. Thoroughly test your algorithm and ensure that it operates as expected.

- Scams and Fraud: Unfortunately, the crypto space is rife with scams, including fraudulent trading algorithms. Do your due diligence before using any algorithm or service, checking for reviews and reputation.

Legality of Crypto Trading Algorithms

As for the legality of crypto trading algorithms, it generally depends on the jurisdiction and the specific activities involved. Algorithmic trading, including crypto trading algorithms, is legal in most jurisdictions, provided it complies with the relevant regulations.

However, certain types of algorithmic trading activities may be regulated or prohibited. For example, practices such as market manipulation or insider trading are illegal in most jurisdictions, regardless of whether they are carried out by a human trader or an algorithm.

Also, keep in mind that regulations around cryptocurrency trading can vary greatly between different countries, and are subject to change as this emerging field continues to develop. Therefore, it’s always a good idea to consult with a legal professional or a financial advisor familiar with your local laws and regulations before getting started with crypto trading algorithms.

The Best Crypto Trading Algorithm

Choosing the Right Crypto Trading Algorithm

When it comes to finding the best crypto trading algorithm, there isn’t a one-size-fits-all answer. The “best” algorithm will depend on your specific needs, goals, and risk tolerance. Here are a few things to consider when choosing a crypto trading algorithm:

- Trading Strategy: Different algorithms employ different trading strategies. Some may use high-frequency trading, while others may focus on arbitrage or trend following. You’ll want to choose an algorithm that aligns with your preferred trading strategy.

- Ease of Use: Some algorithms are more user-friendly than others. If you’re not a seasoned trader or lack technical expertise, you might want to look for an algorithm that’s easy to set up and use.

- Customizability: If you have a particular strategy in mind, you might want an algorithm that allows for customization. This can let you adjust parameters such as risk level, asset allocation, and more.

- Cost: Some algorithms are free to use, while others charge a fee. Consider your budget and how much you’re willing to spend on an algorithm.

- Security: As mentioned earlier, safety should be a priority. Choose an algorithm that prioritizes security and provides robust measures to protect your investment.

- Performance: Check how the algorithm has performed historically. While past performance is no guarantee of future results, it can provide an indication of the algorithm’s effectiveness.

Crypto Trading Algorithms for Beginners

For beginners, it’s important to start with a crypto trading algorithm that’s easy to understand and use. Here are a couple of options:

- FinBrain’s Algorithmic Trading Bot: FinBrain’s Algorithmic Trading Bot is a great option for beginners. It operates on a grid trading strategy, buying low and selling high, which can profit from the volatility in the markets. It can be used for any cryptocurrency pair, allowing users to customize bot parameters and grid sizes. The expected monthly return using the bot is between 5-10%, and it can be run on both Windows and Linux machines.

- Algorithmic Trading Software for Cryptocurrency: There are various software available that are designed for beginners, providing user-friendly interfaces and easy-to-understand analytics. These tools allow beginners to start trading with algorithms without needing to code their own. They often come with pre-built strategies that can be customized as per the user’s needs.

Remember, while crypto trading algorithms can simplify the trading process and potentially enhance profitability, they also come with risks. It’s crucial to understand how they work and to start trading with small amounts until you become more comfortable with the process.

Introduction to FinBrain Technologies

FinBrain Technologies is a leading company in the field of financial technology, specializing in providing AI-assisted, data-driven investing solutions. The company’s innovative products and services are designed to help individual investors maximize their returns in the dynamic world of cryptocurrency trading.

AI Crypto Price Forecasts

One of the key offerings of FinBrain Technologies is its AI crypto price forecasts. Using advanced machine learning algorithms, FinBrain analyzes a vast amount of financial data and news sentiment to generate accurate forecasts for cryptocurrency prices.

These forecasts can be accessed via the FinBrain Terminal, a platform where crypto traders and investors from all around the world can leverage AI crypto forecasts and alternative data in their investment decisions. This data-driven approach not only helps traders make informed decisions but also reduces the risk associated with crypto trading.

By leveraging AI’s power, FinBrain’s crypto price forecasts offer a significant advantage over traditional analysis methods, particularly in the fast-paced and volatile world of cryptocurrency trading.

The FinBrain Algorithmic Trading Bot

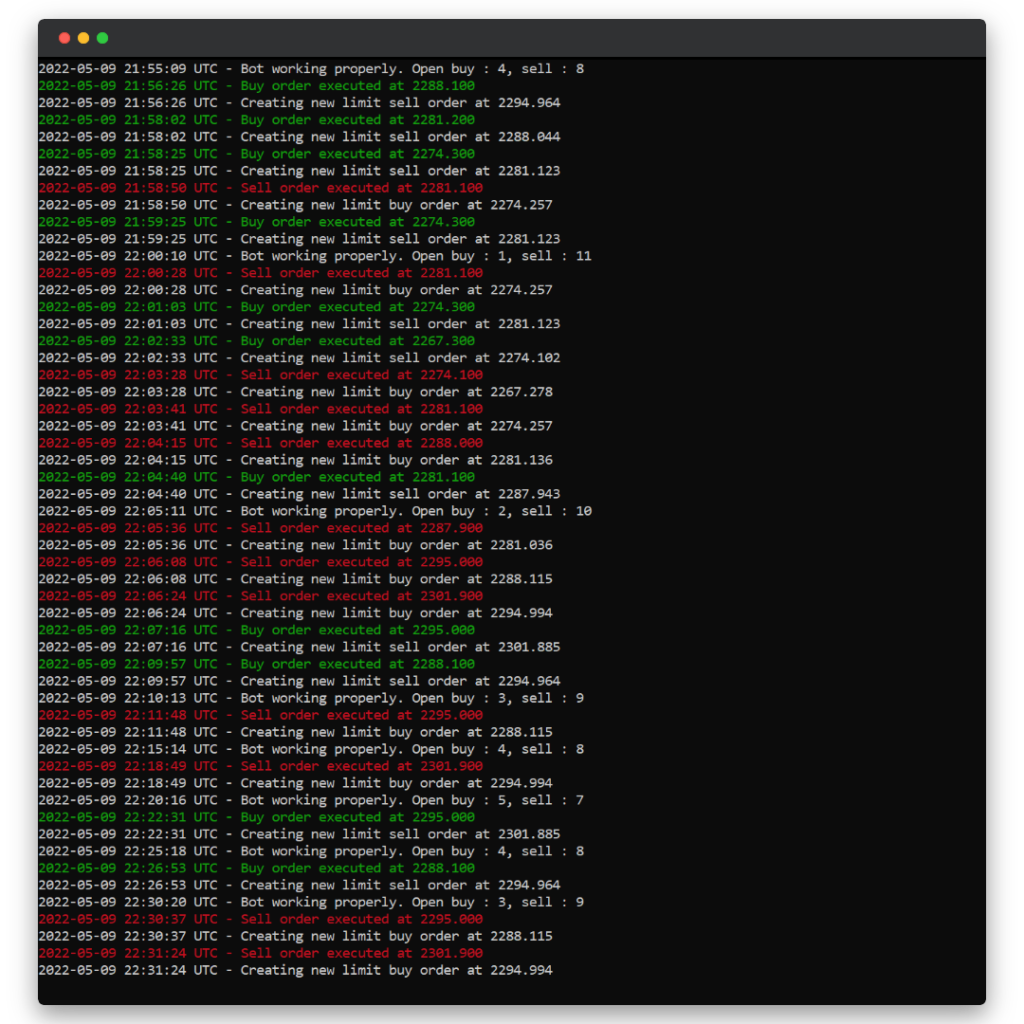

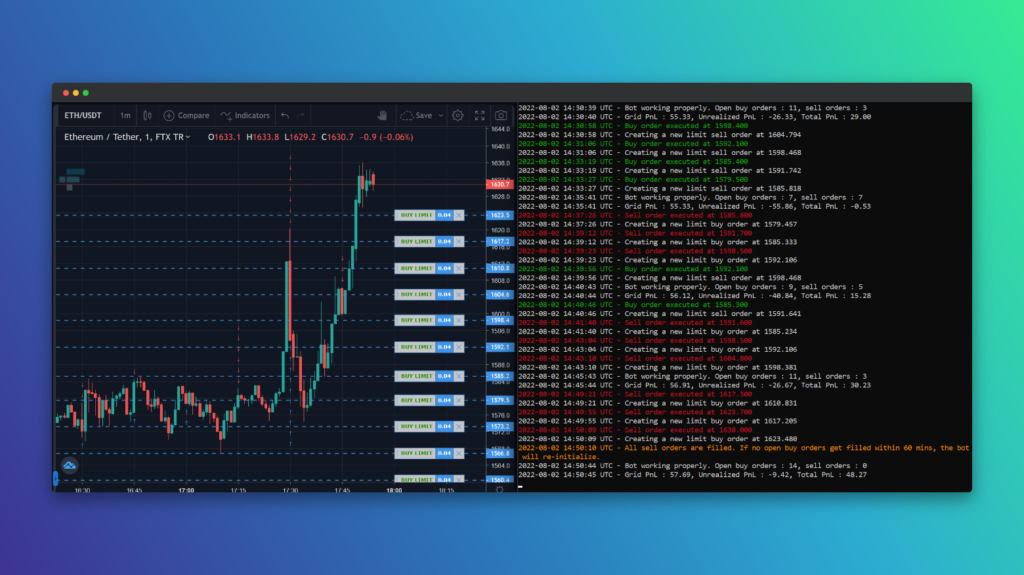

FinBrain Technologies also offers an advanced algorithmic trading bot. This bot operates on a grid trading strategy, a method that can profit from the inherent volatility in the cryptocurrency markets by continuously buying low and selling high.

The FinBrain Algorithmic Trading Bot can be used for any cryptocurrency pair, allowing users to capitalize on the diverse opportunities available in the crypto markets. The bot’s parameters, including the grid sizes, can be customized according to the user’s preferences, offering a high level of flexibility.

Furthermore, the bot can operate 24/7 on autopilot, ensuring that no trading opportunity is missed, regardless of the time of day. It can be run on both Windows and Linux machines, making it accessible to a wide range of users. The expected monthly return using the bot is between 5-10%, making it a lucrative tool for crypto trading.

FinBrain’s commitment to leveraging advanced technology for financial investing, as seen with their AI crypto price forecasts and algorithmic trading bot, makes them a strong player in the financial technology industry. With their products, individual investors have the tools they need to make smarter, data-driven investment decisions.

Conclusion

The world of cryptocurrency trading is dynamic and fast-paced, with traders always seeking an edge over the competition. Crypto trading algorithms have emerged as a powerful tool to help traders navigate this complex landscape. Let’s review the pros and cons of using crypto trading algorithms and compare them to manual trading.

Pros and Cons of Crypto Trading Algorithms

Pros:

- Speed and Efficiency: Crypto trading algorithms can process vast amounts of data and execute trades much faster than humans, resulting in more efficient trading.

- Emotionless Trading: Algorithms remove emotions from the trading process, minimizing the risk of impulsive decisions that could lead to losses.

- 24/7 Trading: Crypto trading algorithms can operate 24/7, ensuring that no trading opportunities are missed.

- Customization: Many algorithms can be customized according to individual risk tolerance and trading goals, providing a personalized trading experience.

Cons:

- Technical Knowledge Required: Setting up and optimizing a crypto trading algorithm often requires technical knowledge, which might be a barrier for some traders.

- Risk of Over-Optimization: There is a risk of over-optimizing an algorithm to the point where it may not perform well in real-world conditions.

- Dependency on Market Conditions: The performance of a crypto trading algorithm depends on market conditions. An algorithm that performs well in one market may not perform as well in another.

- No Guarantee of Profits: Crypto trading algorithms do not guarantee profits, and using them still carries the inherent risks associated with trading.

Crypto Trading Algorithms vs Manual Trading

Crypto trading algorithms offer several advantages over manual trading. They can process data at lightning speeds, removing emotions from the trading process, and operate 24/7. However, they also come with their own set of challenges, such as the need for technical knowledge and the risk of over-optimization.

On the other hand, manual trading allows for more direct control over the trading process, but it can be time-consuming and emotionally taxing. Additionally, manual traders may not be able to take advantage of fleeting opportunities in the market as quickly as an algorithm can.

Ultimately, the choice between using a crypto trading algorithm and manual trading depends on the individual trader’s preferences, goals, and risk tolerance. Some traders may find success with a combination of both approaches, using algorithms to assist with data analysis and decision-making, while retaining manual control over the execution of trades.

FinBrain Technologies

Twitter • LinkedIn • Instagram • Facebook

99 Wall St. Suite #2023, New York, NY 10005