Introduction

Grid Trading Bot is a concept that has gained popularity in the world of trading, particularly in cryptocurrency and forex markets. With the rise of automated trading, it is no surprise that many are turning to these bots to navigate the volatile trading market. The heart of this essay is to explore the world of grid trading bots, how they work, their benefits, and how to utilize them for maximum profit.

What is a Grid Trading Bot?

A Grid Trading Bot is an automated trading bot that executes trades on behalf of the user. It operates on a grid trading strategy, where it buys low and sells high within a pre-determined price range. This strategy is designed to profit from the inherent volatility of the market.

One such bot, the FinBrain Algorithmic Trading Bot, operates on this strategy, enabling users to harvest profits 24/7 on autopilot. This bot can be used for any cryptocurrency pair by connecting to platforms like Binance, Binance US, and FTX.

How Does a Grid Trading Bot Work?

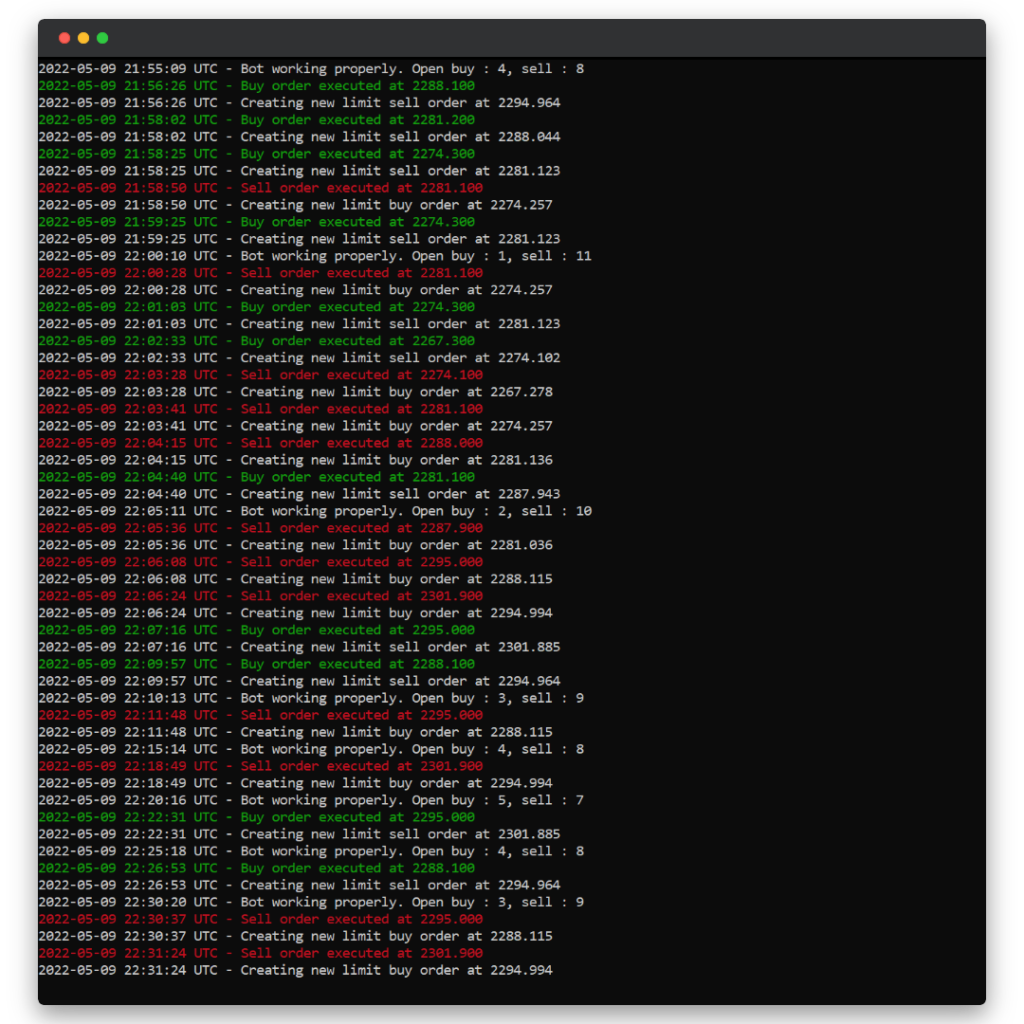

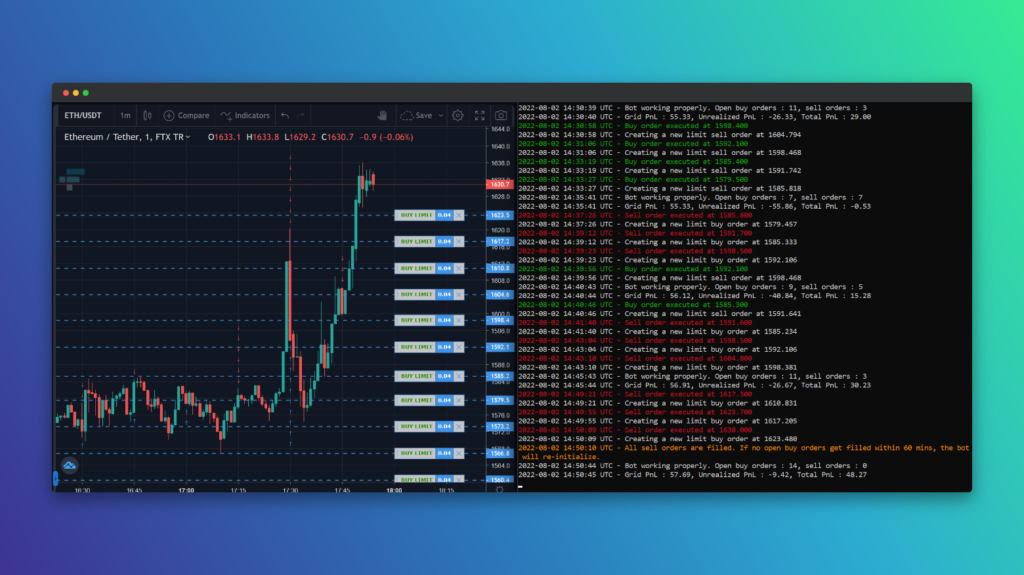

A grid trading bot operates by setting up a series of buy and sell orders at different price levels within a specified range. When the price reaches a buy level, the bot automatically purchases the asset. Conversely, when the price reaches a sell level, the bot sells. This process repeats within the set grid, effectively profiting from the market’s volatility.

The FinBrain Algorithmic Trading Bot leverages this strategy, with customizable grid sizes and parameters, catering to different user preferences and risk appetites.

Benefits of Using a Grid Trading Bot

There are several benefits of using a grid trading bot:

- Automated Trading: The bot operates 24/7, taking advantage of market opportunities even when you’re asleep.

- Profit from Volatility: The bot’s strategy allows it to profit from market fluctuations, buying low and selling high.

- Customizability: Bots like FinBrain’s allow users to adjust the grid parameters to suit their trading strategy and risk tolerance.

- Compatibility: The bot can be run on both Windows and Linux machines.

- Versatility: It can be used for any cryptocurrency pair, making it a flexible trading tool.

Profitability of Grid Trading Bots

Grid trading bots can be a lucrative tool in a trader’s arsenal when used correctly. The profitability of these bots can be influenced by several factors:

Market Conditions

As previously mentioned, grid trading bots perform best in volatile or ranging markets. In these conditions, they can generate profits by executing numerous buy-low and sell-high trades within the grid. However, in strongly trending markets, profitability may decrease unless the bot is equipped with trend-adaptive strategies.

Grid Parameters

The bot’s grid parameters significantly impact its profitability. A wider grid with fewer levels might result in fewer trades but larger profits per trade, while a narrower grid with more levels might lead to more frequent trades but smaller profits per trade. These parameters should be adjusted based on market conditions and the trader’s risk tolerance.

Automation and Time Efficiency

Grid trading bots operate 24/7, executing trades even while the trader is asleep or away from their trading desk. This constant operation can significantly enhance profitability by capitalizing on trading opportunities that manual traders might miss.

AI and Data-Driven Strategies

Grid trading bots that utilize AI and data-driven strategies, like the FinBrain Algorithmic Trading Bot, can potentially enhance profitability. These bots use AI to analyze vast amounts of data and predict future price movements, informing their trading decisions and potentially increasing profits.

Diversification

Using the bot to trade multiple asset pairs simultaneously can help spread risk and increase potential profits. For instance, the FinBrain Algorithmic Trading Bot can be used for any cryptocurrency pair, enabling users to diversify their crypto trading.

It’s important to note that while grid trading bots can enhance profitability, they do not guarantee profits. Trading always involves risks, and it’s crucial to manage these risks effectively to maintain consistent profitability. The FinBrain Algorithmic Trading Bot, with its customizable parameters and AI-driven strategies, offers a potentially profitable tool for navigating the volatile crypto markets. However, the expected monthly return using the bot is between 5-10%, and users should always perform their own risk assessment before trading.

Market Conditions for Grid Trading Bots

Grid trading bots operate effectively under specific market conditions. Understanding these conditions is essential for maximizing the bot’s performance. Here are the key market conditions that impact grid trading bots:

Sideways or Ranging Market

In a sideways or ranging market, the price of an asset fluctuates within a specific range without a clear upward or downward trend. This condition is ideal for grid trading bots as they capitalize on these fluctuations by buying low and selling high within the grid.

Volatile Market

Volatile markets, characterized by frequent and significant price swings, can be advantageous for grid trading bots. Higher volatility increases the number of price levels that the bot can trade within the grid, potentially leading to more trading opportunities and higher profits.

Moderate Trending Market

Grid trading bots can also operate in moderately trending markets, given the right strategy and parameters. For instance, in a moderate uptrend, a bot could place more buy orders at lower levels to catch potential price dips, while in a moderate downtrend, it could place more sell orders at higher levels.

Strong Trending Market

Strongly trending markets pose a challenge for grid trading bots. In a strong uptrend, the bot could get stuck with buy orders at lower levels that never get filled, missing out on the upward movement. Similarly, in a strong downtrend, the bot could end up holding assets bought at higher levels, leading to potential losses.

Market Liquidity

Liquidity refers to the ability to quickly buy or sell an asset without causing a significant price change. Markets with high liquidity are beneficial for grid trading bots as they allow for faster execution of trades at desirable prices.

In conclusion, while grid trading bots can operate in various market conditions, they perform best in sideways or volatile markets. It’s crucial to monitor market conditions regularly and adjust the bot’s parameters accordingly to optimize its performance. The FinBrain Algorithmic Trading Bot offers customizable grid sizes and parameters, enabling users to adapt to changing market conditions effectively.

Setting Up a Grid Trading Bot

Setting up a grid trading bot is relatively straightforward. Users need to connect the bot to a trading platform (like Binance or FTX), set the grid parameters, and let the bot execute trades automatically. For a detailed grid trading bot setup guide, refer to the comprehensive tutorials on the FinBrain Algorithmic Trading’s website.

Platforms Supporting Grid Trading Bots

Several platforms support grid trading bots, including Binance, Binance US, and FTX. These platforms allow users to connect their trading bots and execute automated trades seamlessly. FinBrain’s algorithmic trading bot is fully compatible with these platforms, providing a robust and versatile trading tool.

Choosing the Best Grid Trading Bot

Selecting the most suitable grid trading bot is a crucial step towards successful automated trading. Here are some factors to consider:

Performance and Profitability

The primary indicator of a good grid trading bot is its track record of performance and profitability. Look for bots with a proven history of generating positive returns.

Customization

A good grid trading bot should allow users to customize the bot’s parameters to suit their trading strategy and risk tolerance. This includes adjusting the grid size, price range, and the amount to invest per trade.

Platform Compatibility

The bot should be compatible with major trading platforms. This would allow you to connect the bot to your preferred platform and execute trades seamlessly. For instance, the FinBrain Algorithmic Trading Bot is compatible with Binance, Binance US, and FTX.

Security

Security is a critical aspect when choosing a grid trading bot. The bot should have robust security measures in place to protect your investments from potential cybersecurity threats.

Customer Support

Effective customer support is essential, especially for beginners who might need help setting up or troubleshooting the bot. Look for bots backed by a responsive and helpful customer support team.

AI and Data-Driven Features

Advancements in AI and data analytics have made it possible for bots to utilize these technologies for trading. Bots like the FinBrain Algorithmic Trading Bot leverage AI and alternative financial data to make informed trading decisions.

Ease of Use

Especially for beginners, the interface should be intuitive and user-friendly. It should be easy to set up the bot, adjust its settings, and monitor its performance.

Based on these factors, the FinBrain Algorithmic Trading Bot is an excellent choice for both beginner and experienced traders. It offers customizable grid sizes, operates 24/7, is compatible with major trading platforms, and uses an AI-assisted, data-driven approach to maximize returns. It’s always important, however, to do your own research and choose a bot that best aligns with your trading goals and risk appetite.

Risks of Using a Grid Trading Bot

While grid trading bots can offer significant advantages, it’s important to understand the potential risks associated with using them. Here are some of the main risks to consider:

Market Risk

The primary risk of using a grid trading bot is associated with the unpredictability of the markets. Grid trading bots work best in volatile markets that fluctuate within a specific range. In strong trending markets where the price consistently moves in one direction, the bot may end up buying high and selling low, resulting in potential losses.

Systemic Risk

Systemic risks are associated with the bot’s operational aspects. These can include system failures, bugs, or connectivity issues that may impact the bot’s trading activities. For instance, if the bot loses connection to the trading platform or experiences a glitch during a critical trade, it could lead to substantial losses.

User Error

Grid trading bots require the user to set certain parameters like the grid size, price range, and the amount to invest per trade. If these parameters are incorrectly set, it could lead to suboptimal performance or losses. For instance, setting a very wide grid in a less volatile market could result in fewer trades and lower profits.

Regulatory Risk

Depending on your location, there may be regulations governing the use of trading bots. It’s crucial to ensure that you’re in compliance with these regulations to avoid potential legal issues.

Security Risk

Cybersecurity is a major concern in the digital age. If a trading bot or the platform it’s connected to is compromised, there could be a risk of losing your investments. It’s essential to use reputable bots and platforms with robust security measures in place.

While these risks may seem daunting, they can be mitigated with careful planning, regular monitoring, and the use of reliable, secure bots like the FinBrain Algorithmic Trading Bot. It’s also important to stay informed about market conditions and adjust your bot’s parameters accordingly to optimize its performance.

Grid Trading Bot Strategies

Grid trading bots offer several strategies that users can implement to cater to various market conditions and personal trading preferences. Here are a few key strategies:

Buy Low, Sell High Strategy

The most basic grid trading bot strategy is the “buy low, sell high” approach. The bot is set to automatically purchase an asset when the price hits a lower level in the grid and sell when the price hits a higher level. This strategy can be particularly effective in volatile or ranging markets where price fluctuations are frequent.

Trend-Adaptive Strategy

Some bots, like the FinBrain Algorithmic Trading Bot, can adapt to trending markets by adjusting the grid parameters. For example, in an uptrend, the bot could place more buy orders at lower levels to catch potential price dips. Conversely, in a downtrend, it could place more sell orders at higher levels to capitalize on potential price rallies.

AI-Assisted Strategy

With advancements in technology, AI-assisted strategies are becoming increasingly prevalent. These strategies leverage artificial intelligence to analyze vast amounts of data and predict future price movements. The FinBrain Algorithmic Trading Bot, for instance, utilizes AI and alternative financial data to inform its trading decisions. Users can access these AI forecasts and alternative data through the FinBrain Terminal.

Customized Strategy

Grid trading bots often allow users to customize their strategies. For instance, users can adjust the grid’s range and the number of levels within the grid. A wider range with fewer levels could be more suited to a less volatile market, while a narrower range with more levels could be optimal in a highly volatile market. Customization allows each trader to tailor the bot to their risk tolerance and trading goals.

Diversified Portfolio Strategy

In this strategy, users employ the bot to trade multiple asset pairs simultaneously. This diversification can help spread risk and increase potential profits. For instance, the FinBrain Algorithmic Trading Bot can be used for any cryptocurrency pair, enabling users to diversify their crypto trading.

Remember, each strategy comes with its own set of risks and rewards. It is important to monitor your bot’s performance regularly and adjust your strategy based on market conditions and your trading objectives. For more detailed grid trading bot strategies for volatile markets, refer to the strategy guides available on the FinBrain Algorithmic Trading’s website.

Conclusion

In conclusion, grid trading bots offer an innovative way to navigate the volatile trading market. They automate the trading process, allow you to profit from market volatility, and can be customized to suit individual trading strategies.

Whether you’re a beginner looking for a grid trading bot for beginners or an experienced trader wanting to optimize your trading strategy, understanding how these bots work can significantly impact your trading success. The FinBrain Algorithmic Trading Bot is an excellent tool to consider, with its AI-assisted trading strategy, customizable parameters, and proven track record. As always, remember to monitor your trading bot’s performance, adjust parameters as needed, and stay informed on the latest crypto price predictions provided by FinBrain Terminal.

FinBrain Technologies

Twitter • LinkedIn • Instagram • Facebook

99 Wall St. Suite #2023, New York, NY 10005