Introduction to AI Crypto Trading

With the increasing complexity of the crypto market, AI in crypto trading is becoming more prevalent. As a subset of automated crypto trading, AI trading uses machine learning and data analysis to optimize crypto trading strategies, making it an essential tool for maximizing returns in the volatile world of cryptocurrency.

AI crypto trading involves using artificial intelligence to analyze and forecast trends in the crypto market, which allows for more informed trading decisions. It combines the capabilities of artificial intelligence with the dynamic nature of cryptocurrency trading to create a more efficient and potentially profitable trading environment.

Understanding How AI Crypto Trading Works

AI crypto trading operates by using advanced algorithms that can analyze vast amounts of data from the crypto market in a fraction of the time it would take a human. These algorithms are capable of recognizing patterns and trends that may not be immediately apparent, providing valuable insights for crypto trading.

The process begins with data collection where the AI system gathers historical and real-time data from various sources. This data is then processed, analyzed, and interpreted by the AI to predict future market behavior. Based on these predictions, the AI system can recommend or execute trades, maximizing potential profits and minimizing potential losses.

Benefits and Risks of AI in Crypto Trading

The use of AI in crypto trading comes with its set of advantages and disadvantages. On the one hand, AI allows for more accurate forecasting, risk management, and efficient trading, providing an edge in the competitive crypto market.

AI systems can analyze large amounts of data, identify patterns, and make accurate predictions at a speed and efficiency that surpasses human capabilities. This leads to more informed trading decisions, potentially higher returns, and a reduced risk of human error. Automated crypto trading also allows for round-the-clock trading, taking advantage of the crypto market’s 24/7 operation.

On the other hand, there are risks associated with AI crypto trading. These include reliance on technology, possible software glitches, and the risk of over-optimization where an AI system might tailor its predictions too closely to past data, neglecting the unpredictable nature of the crypto market.

A Comparative Study: AI in Crypto Trading Vs Manual Trading

When compared to manual trading, AI crypto trading offers significant advantages. AI systems can process vast amounts of data quickly and accurately, something that would be time-consuming and prone to error for a human trader. AI trading systems can also trade 24/7, taking advantage of the non-stop nature of the crypto market.

While manual trading allows for a personal touch and intuition-based decisions, it also exposes traders to emotional trading and human errors. AI systems, on the other hand, operate based on data, eliminating emotional bias and enabling more rational and calculated trading decisions.

Introduction to AI Crypto Trading Bots

A crypto trading bot is a type of AI trading software that automates the process of buying and selling cryptocurrencies. These bots use AI and machine learning to analyze market trends and execute trades based on predefined criteria. AI trading bots have become increasingly popular due to their ability to operate continuously and make calculated decisions based on market data.

Traders and investors can utilize AI trading bots to automate their trading strategies and take advantage of market fluctuations even when they are not actively trading. This allows for continuous trading, maximizing the chances of achieving positive returns.

FinBrain Technologies: AI Crypto Forecasting and Trading Bots

FinBrain Technologies is at the forefront of AI crypto trading, providing AI-assisted and data-driven investing solutions. The company offers AI crypto price forecasts and alternative financial data, including news sentiment analysis and detailed technical reports. These resources can assist individual investors in maximizing their crypto returns.

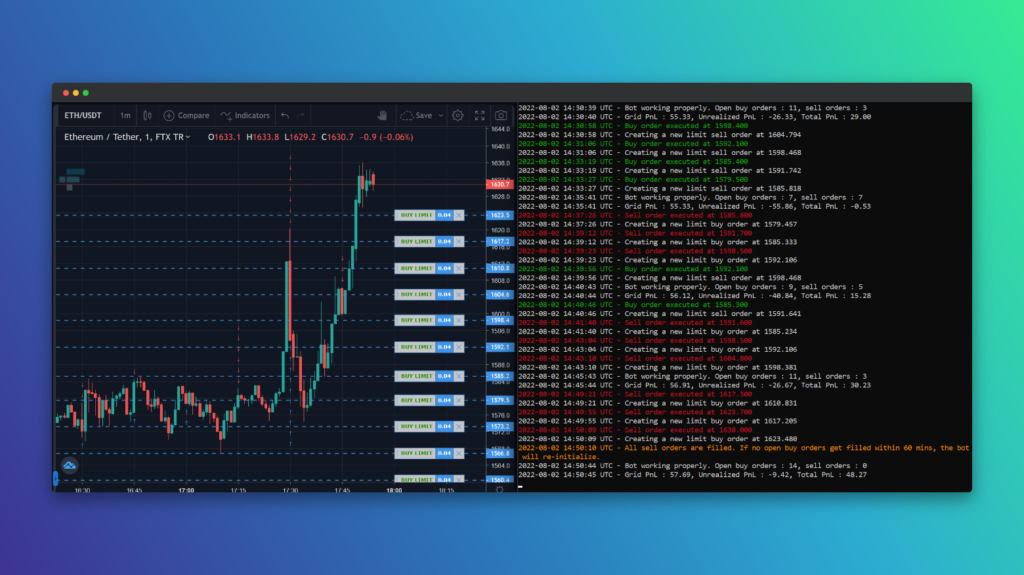

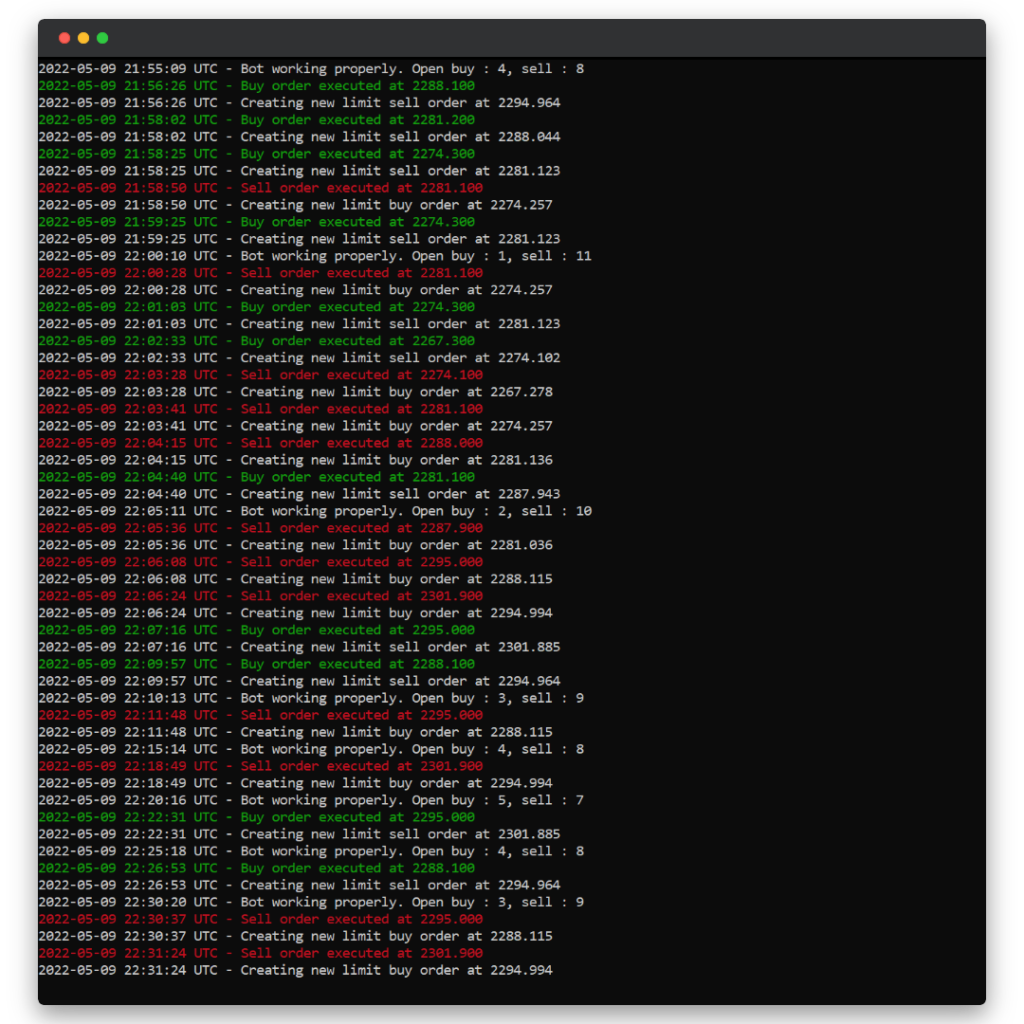

A standout product in FinBrain’s portfolio is the FinBrain Algorithmic Trading Bot. This AI-powered bot operates on a grid strategy, continuously buying lows and selling high. This approach allows traders to profit from the volatility in the markets 24/7.

FinBrain’s Trading Bot can be used for any cryptocurrency pair by connecting to popular exchanges such as Binance, Binance US, and FTX. Users can customize the bot’s parameters, including the grid sizes, according to their trading preferences. The bot, which can run on Windows and Linux machines, offers an expected monthly return of between 5-10%.

In addition to the trading bot, FinBrain also provides a valuable resource for crypto traders and investors worldwide through the FinBrain Terminal. Here, users can access AI crypto forecasts and alternative data to aid their investment decisions.

Grid Trading Strategy and Grid Trading Bots

A grid trading strategy is a method that profits from the volatility in the crypto markets. This strategy involves placing buy and sell orders at regular intervals (grid levels) above and below a predefined base price. When the price moves, the trading bot executes the appropriate buy or sell order, securing profits.

The FinBrain Algorithmic Trading Bot is a prime example of a grid trading bot. It continuously buys lows and sells high, harvesting profits 24/7 on autopilot. Users can customize the bot’s parameters to suit their trading preferences and can use it for any cryptocurrency pair.

Choosing the Best AI Crypto Trading Platform

When choosing the best AI for crypto trading, it’s important to consider a few key factors:

- Accuracy: The AI should provide accurate and reliable trading signals and forecasts.

- User-friendliness: The platform should be easy to use and navigate, especially for beginners.

- Security: The platform should have robust security measures in place to protect user data and funds.

- Customer Support: Good customer service is crucial, especially when dealing with technical issues or queries.

- Features and Functionalities: Look for platforms that offer useful features such as automated trading, real-time market data, and customizable trading strategies.

Consider these factors while checking out AI crypto trading reviews and making your selection.

Concluding Remarks

As the crypto market continues to evolve, AI crypto trading is set to become an integral part of this landscape. With its ability to analyze massive amounts of data and execute trades based on market trends, AI offers significant advantages over traditional manual trading.

Whether you’re a beginner or an experienced trader, understanding how AI works in crypto trading, its benefits, and risks, and how to choose the right platform is crucial. With its advanced AI forecasting and trading bot, FinBrain Technologies provides a comprehensive solution for anyone looking to venture into the world of AI crypto trading.

FinBrain Technologies

Twitter • LinkedIn • Instagram • Facebook

99 Wall St. Suite #2023, New York, NY 10005